🚢 Freight Weekly Update [8–18 July 2025]

Global Freight & Logistics Highlights

Mid-July 2025 sees the global logistics market navigating continued uncertainty. Key challenges include the escalation of U.S. trade tariffs, shifting carrier strategies, and widespread port congestion. Thai and ASEAN exporters are especially impacted by the resurgence of trade protectionism.

If you’re ready, let’s dive into the key developments:

=========================

💡 Compare freight rates from at least 3 carriers with just one click.

Plan your logistics smarter and more cost-effectively.

📌 Register for free: https://zupports.co/en/register-eng/

=========================

🇺🇸 U.S. Tariff Policy Shakes Export Markets:

Thailand hit with 36%, Vietnam settles at 20%, Indonesia down to 19%

The U.S. is moving aggressively on its “Reciprocal Tariffs” strategy:

-

President Trump is sending tariff letters to over 10 countries daily. Tariffs are expected to take effect from 1 August 2025, pending formal executive action.

-

📌 Latest announced tariff rates:

-

25%: Japan, South Korea, Malaysia, Kazakhstan, Tunisia

-

30%: EU, Mexico, Canada, South Africa, Bosnia

-

32%: Indonesia (before revised to 19% per new deal)

-

35%: Canada, Brazil, Serbia, Bangladesh

-

36%: Thailand, Cambodia

-

40%: Laos, Myanmar

-

Highlights:

-

Vietnam: Secured a temporary deal at 20% (originally 46%), but goods transshipped from China via Vietnam still face a 40% tariff.

-

Indonesia: New deal announced on 15 July reduces the tariff to 19%, but no official documents yet.

-

EU: Delays its retaliation until early August to allow for negotiations.

-

USTR: Initiates a Section 301 investigation into Brazil’s digital and trade policies.

Other new U.S. tariff announcements:

-

BRICS: +10% tariff over existing duties

-

Pharmaceuticals: Up to 200% tariff unless production relocates to the U.S. within a year

-

Copper: 50% tariff effective 1 August

-

Russia: 100% tariffs if no peace deal with Ukraine in 50 days. Applies to any nation trading with Russia.

📌 Note:

- Transshipped goods to avoid tariffs will be taxed at the highest origin-based rate.

- Unclear if USMCA members (Canada, Mexico) will receive exemptions.

- These reciprocal tariffs are add-ons to existing MFN, AD, or other tariffs.

📦 Global Container Demand Recovery—Except North America

May 2025 Global Container Volumes:

-

Worldwide: +1.8% YoY

-

Excluding North America: +5.6% YoY

However, North America demand drops sharply:

-

Imports: −9.4%

-

Exports: −8.1%

-

Pacific Lane: Imports −15%, Exports −16%

→ Carriers are shifting focus to Intra-Asia, Middle East, and Europe lanes.

🚢 Carrier Trends and Fuel Impact

-

Hapag-Lloyd: GRI of $1,000/FEU on ISC & Middle East → North America routes.

-

ONE: Launched Finland Express 2, powered by methanol fuel, in partnership with X-Press Feeders.

-

Capacity Cuts: On Transpacific lanes as bookings decline.

-

On-time performance: Slight improvement in June, but still <65% globally, especially weak on Asia–U.S.

-

VLSFO bunker fuel: +$35/ton since April.

⚓ Major Port Congestion: Asia, Middle East, and Europe Face Critical Delays

Asia

-

Singapore, Port Klang, Shanghai: Still highly congested.

⏳ Delay: 7–10+ days; Recommend buffer of 10–15 days -

Vietnam (HCM, Haiphong, Vung Tau): Yard utilization 80–90%

⏳ Delay: 0.5–1 day average -

Laem Chabang (Thailand): Trucking improves; return containers ≥1 day in advance

-

Pakistan & Bangladesh: Advance bookings 2–3 weeks, especially for DG cargo

-

Jebel Ali (UAE): Inventory stockpiling, especially from China (+300% export spike in early July)

China

-

Shanghai: YS Terminal: 2–3 days, WGQ: 1.5–2 days

-

Qingdao & Ningbo: 30–100+ ships waiting

-

Xiamen: Closed 7 hours due to fog

Europe

-

Antwerp & Hamburg: Dwell times 7–8 days, labor shortages due to summer

-

Zeebrugge: Used to relieve Antwerp pressure

-

Algeciras: Prioritizing heavy export ships to reduce yard congestion

-

Rotterdam: RWG → 5 days berth delay, ECT → delays during peak hours

Americas

-

Los Angeles: Record high volumes (due to China tariff pause expiration)

-

Mexico (Altamira, Veracruz): At risk during hurricane season

-

New York: APMT Port Elizabeth closed 15 July from power outage

-

Canada (Vancouver): Rail dwell time: 9 days

Africa

-

Durban (South Africa): Avg. wait: 2.5 days

-

Mombasa (Kenya): 5.6 days wait

-

Skikda (Algeria): Longest delays at 6.5 days

Central & South America

-

Manzanillo (Mexico): Utilization 91%

-

Callao (Peru): Delays from road closures

-

El Salvador – Acajutla: Delay improved from 10 → 3–4 days

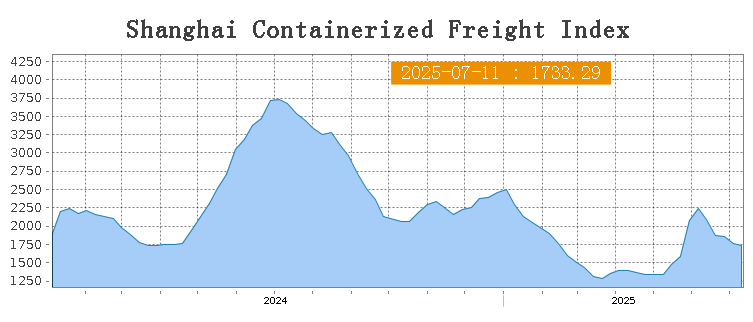

📉 Freight Rates: Mixed Trends, Asia–US Weakens, Intra-Asia Rising

-

Asia → USWC:

-

SCFI down to March 2025 levels

-

SCFI (11 July 2025): 1,733.29

-

-

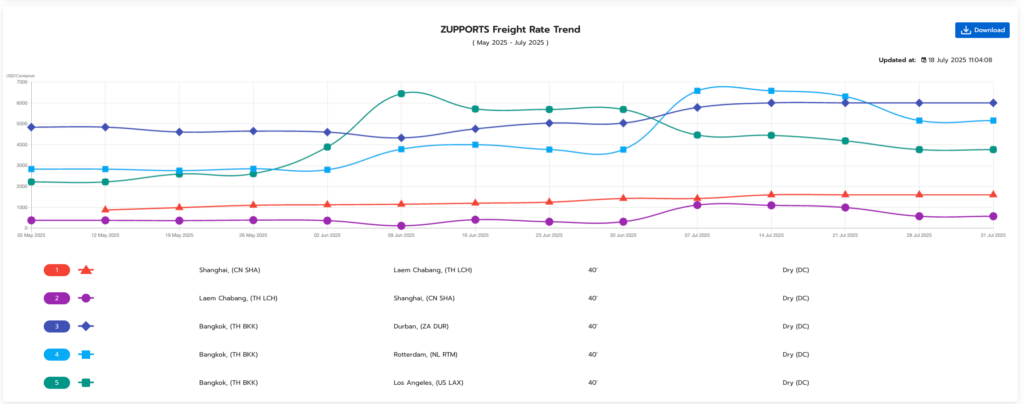

ZUPPORTS Rate Trends:

-

Thai exports to the U.S.: Freight rates declining

-

Intra-Asia lanes: Rates increasing

-

=========================

💡 Compare freight rates from at least 3 carriers with just one click.

Plan your logistics smarter and more cost-effectively.

📌 Register for free: https://zupports.co/en/register-eng/

=========================

📌 Track real-time rate trends and book smarter with ZUPPORTS: https://zupports.co/en/register-eng/